Leasing Explained

If you haven't already considered leasing, we could have an option that works for you. We offer a wide range of different funding solutions tailored to you.

Leasing gives you the chance to drive a new car every few years, with relatively low monthly payments and no worries about the car’s resale value. There are two main types of car leasing deals – personal contract hire (PCH) and personal contract purchase (PCP). Both come with strings attached, so make sure you understand how they work.

Restrictions when you lease a car

Top tip

It’s good to compare APR rates, but make sure you look at the total repayment amount as well as balloon payments are not included in the APR rates.

Leasing a car is effectively long-term rental – you pay a fixed monthly fee to use the car for an agreed time period and number of miles.

Under a PCH agreement, you never own the vehicle and you have to hand it back at the end of the term. With a PCP agreement, you have the option to buy the vehicle at the end of the term in exchange for a balloon payment.

With PCP you also need to pay a deposit and with PCH you usually have to pay three months’ rental in advance.

As with all rental agreements, there are some restrictions you need to bear in mind:

1

Cancelling your contract early may result in a fee or the requirement to pay remaining rental payments.

2

Modifications to the car, such as adding a tow-bar, require permission from the leasing company.

3

Exceeding the agreed mileage will incur a penalty at the end of the agreement.

4

The car must be returned in good condition, with charges for any damages beyond fair wear and tear, and written permission may be needed for taking the car abroad, with potential additional charges.

Choosing between personal contract hire (PCH) and personal contract purchase (PCP)

Top tip

If you’ve taken out a PCP plan and intend to buy the car at the end of it, start saving up the balloon payment now.

People save money faster if they have a definite savings goal, so find out how to set a savings goal.

If you decide that leasing a car is your best option, here are the main points to consider when choosing between personal contract hire and personal contract purchase.

Non-fuel running costs: with PCH your monthly payment includes a maintenance package to cover non-fuel running costs, such as annual car tax (commonly known as road tax) and routine servicing. With PCP an optional maintenance package is sometimes available.

Monthly payments: these are generally lower for PCH than for PCP, although you often have to pay for the first three months in advance. The monthly payments for PCH also tend to be lower than for a personal car loan.

Freedom to change supplier at the end of the contract: with PCH you’re free to choose whether to start leasing a new car from the same company or shop around for a better deal elsewhere. Whereas with PCP you may have to stay with the same dealer to be able to use any remaining equity in your car as a deposit for a new car through PCP.

Worries about the car’s future: with PCH you don’t have to worry about depreciating value, warranty expiry, or selling it on – that’s the leasing company’s concern. The same applies to PCP, unless you’re planning to buy the car at the end of the contract (see below).

The big difference between PCP and PCH

Top tip

Four out of five people with PCP plans don’t opt to buy the car at the end of their contract (Source: the Finance and Leasing Association).

Is it likely that you’ll be one of them? If so, leasing a car through personal contract hire (PCH) may work out cheaper for you.

The big difference between PCP and PCH is that PCP gives you the opportunity to buy the car and become its legal owner at the end of the leasing contract.

To do this, you have to pay a ‘balloon payment’ – also known as the Guaranteed Minimum Future Value (GMFV) – at the end of the contract. This is in addition to your deposit and monthly payments.

With PCP the total amount you repay in monthly instalments is based on an estimate of how much the car will lose in value though depreciation between the start and end of the contract.

If at the end of the contract you don’t want to buy the car, you simply hand it back. As long as the car is in good condition and hasn’t exceeded the agreed mileage, you won’t have to pay any more money.

With both PCH and PCP the lender can repossess the car without a court order. But for PCP, once you have paid at least a third of the total amount payable, they can’t repossess it without a court order.

Using your car as equity to lease a new car

Usually the finance company or car dealer will set up a PCP plan so that the balloon payment agreed at the start of the contract will be less than the car’s market value at the end of the contract.

Assuming this difference in value still exists by the end of your plan, you can use the money as a deposit for leasing a new car through PCP.

Your rights if you want to cancel a PCP plan

Choosing the right PCP term is important. Opt for a lengthy period and you’ll end up paying more for the car. But if it’s too short, you’ll have higher monthly payments and could risk not being able to meet them.

- If you can’t keep up your payments or simply want to cut costs, you have the right under the Consumer Credit Act to return the car as long as you’ve already made half of your payments. This is called ‘voluntary termination’.

Business Leasing

There are many advantages to business leasing not to mention you will be driving a brand new vehicle that can help to build and maintain your brand reputation, whilst keeping your employees feeling reassured, they are on the road with the latest safety technology. We can also help you on your journey to going green, with a range of electric and hybrid vehicles.

Many businesses still feel owning their vehicles is the best option, but there is an alternative. Rather than tying up large sums of capital in depreciating assets, you can lease your vehicles with a low initial outlay and fixed monthly payments for easy budgeting.

Furthermore, VAT registered businesses can enjoy tax benefits when choosing business contract hire. You can claim back up to 50% of the VAT if the vehicles are used for both business and personal use. If you are using your vehicle fleet strictly for business, you could claim back up to 100% of the VAT.

By leasing your business fleet, you and your staff can continuously drive the newest vehicles, enhancing your company's reputation and helping to keep your employees safe with the latest technology and safety features.

All this without having to worry about depreciation - as the finance company owns the vehicles and take on the risks associated with residual values and disposals.

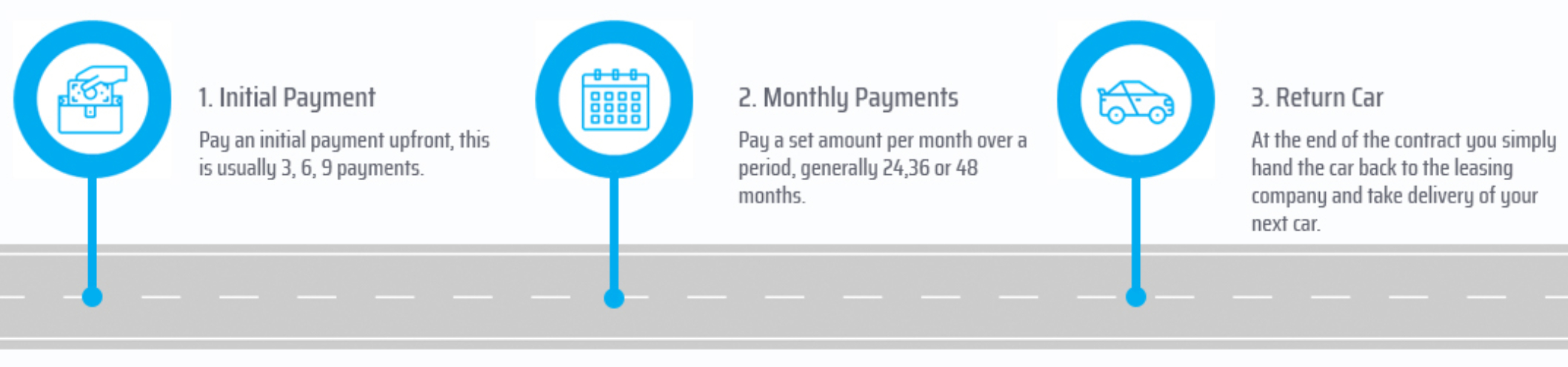

WHAT IS LEASING?

Easy as 1, 2, 3

Flexible Leasing Options

We offer a range of flexible funding options that might be right for you.

Leasing lets you drive a new car every few years with lower monthly payments and no worries about resale value. The two main options — Personal Contract Hire (PCH) and Personal Contract Purchase (PCP) — work differently, so it’s important to understand both.

> Watch the video to learn more >

Top Tip:

Compare total repayment costs, not just APR — balloon payments aren’t included in APR and can add up.